XNTE.CH

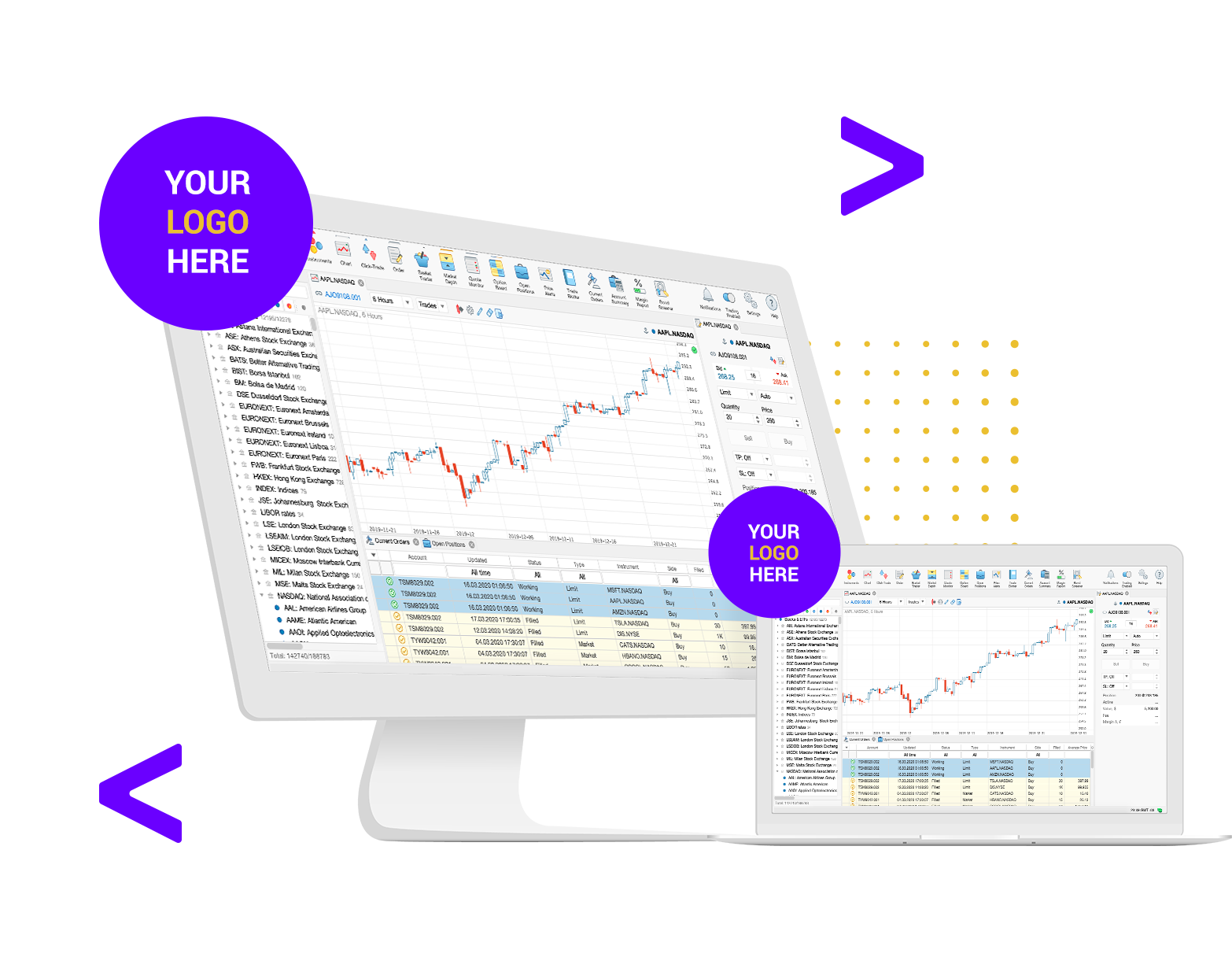

Branded trading platforms for financial institutions

We offer turnkey trading terminals to banks and major financial organisations. Market-tested financial technology for your clients!

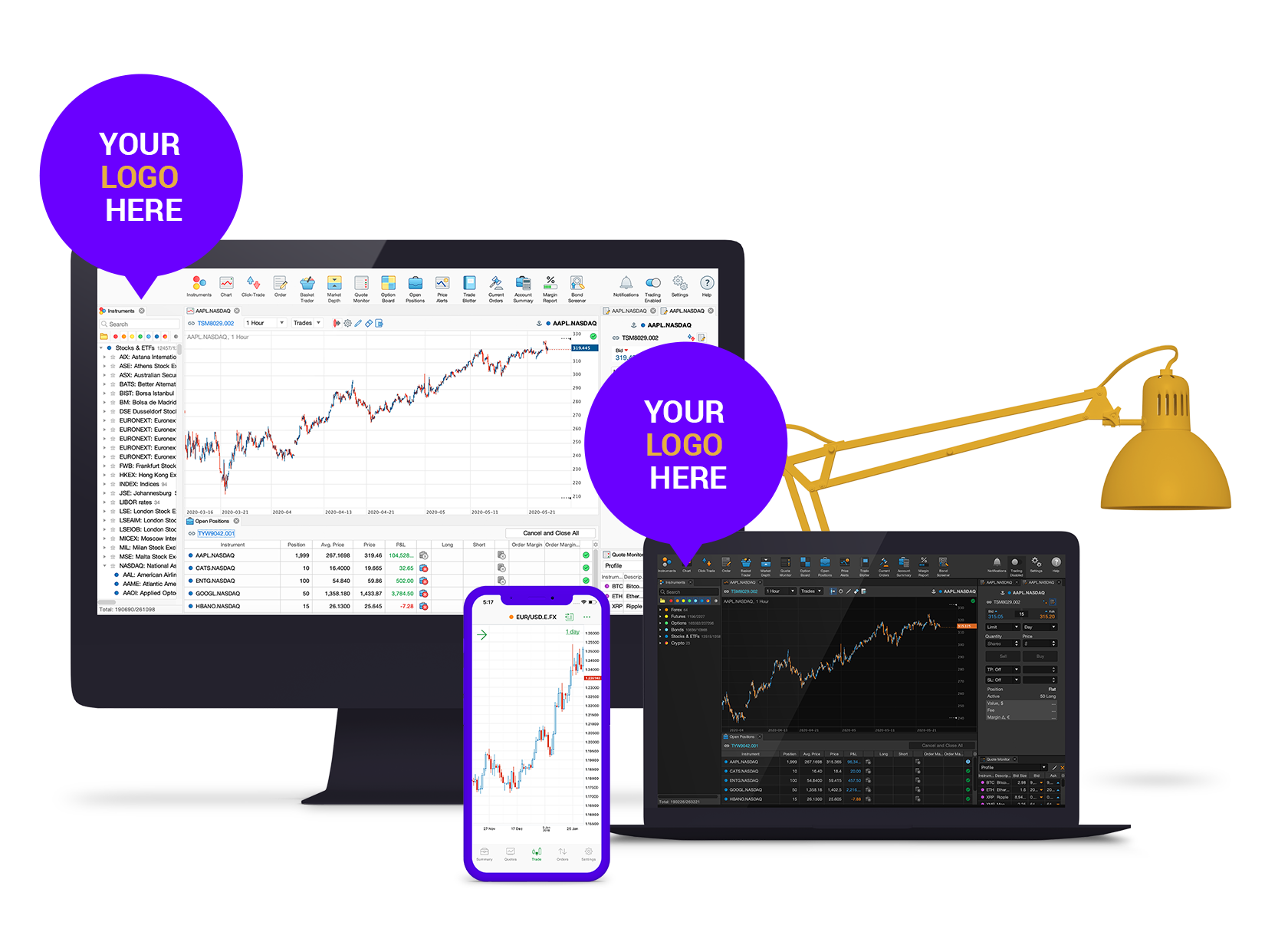

Desktop, web and mobile multi-asset trading platforms

Connectivity tools - FIX and HTTP APIs - to stream live market quotes

Do you represent a seasoned investment company, bank or brokerage?

Do you hold a valid license to render investment services?

Are you looking for a solid technology to boost your offerings?

If the answer is "YES", Xntech's trading technology is your ultimate choice.

In a Nutshell

Choose the options/models with your dedicated manager

Sign

an agreement

an agreement

Get your branded trading solution on time and on budget

01

02

03

Enable data feeds for your trading terminal

04

05

How it Works

Steps to your branded technology:

Perform client onboarding while we manage the back end

User-friendly interface with your corporate branding

Partner Perks

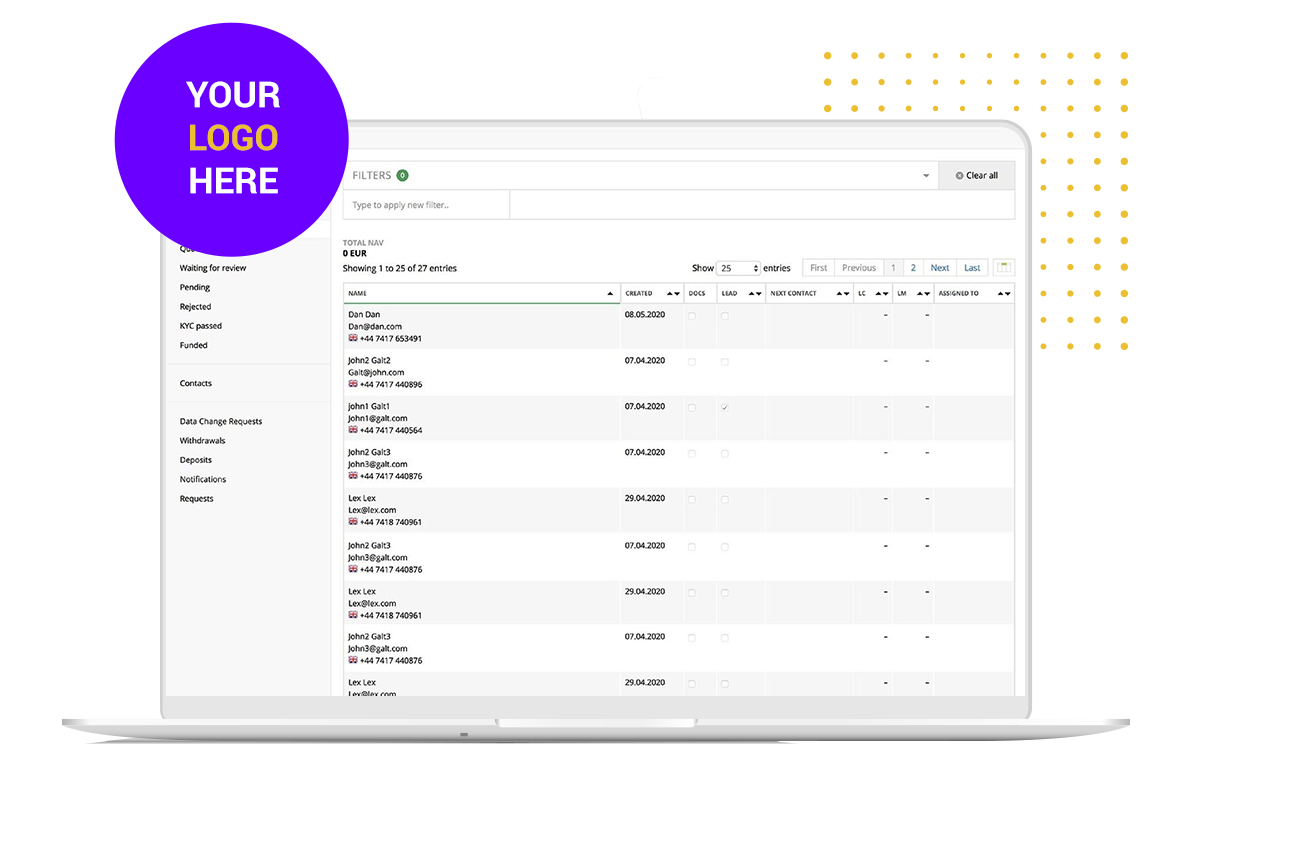

Transparency and full control over end client activity

Real-time reporting and statistics for each end client

Dedicated Manager

The platform modules undergo Big Four company audits on a regular basis to ensure the ultimate user experience.

Our software is fully MiFID II compliant - from onboarding to reporting.

Our software is fully MiFID II compliant - from onboarding to reporting.

A decade of technological experience delivered to you in a fully branded trading terminal.

< Easy setup >

< Dedicated tech resources >

< Quick delivery >

< Corporate branding >

< Regular platform updates >

< Security and transparency, full data encryption >

Options and Editions

Choose the solution that best fits your needs or deliver the all-in-one package to your customers:

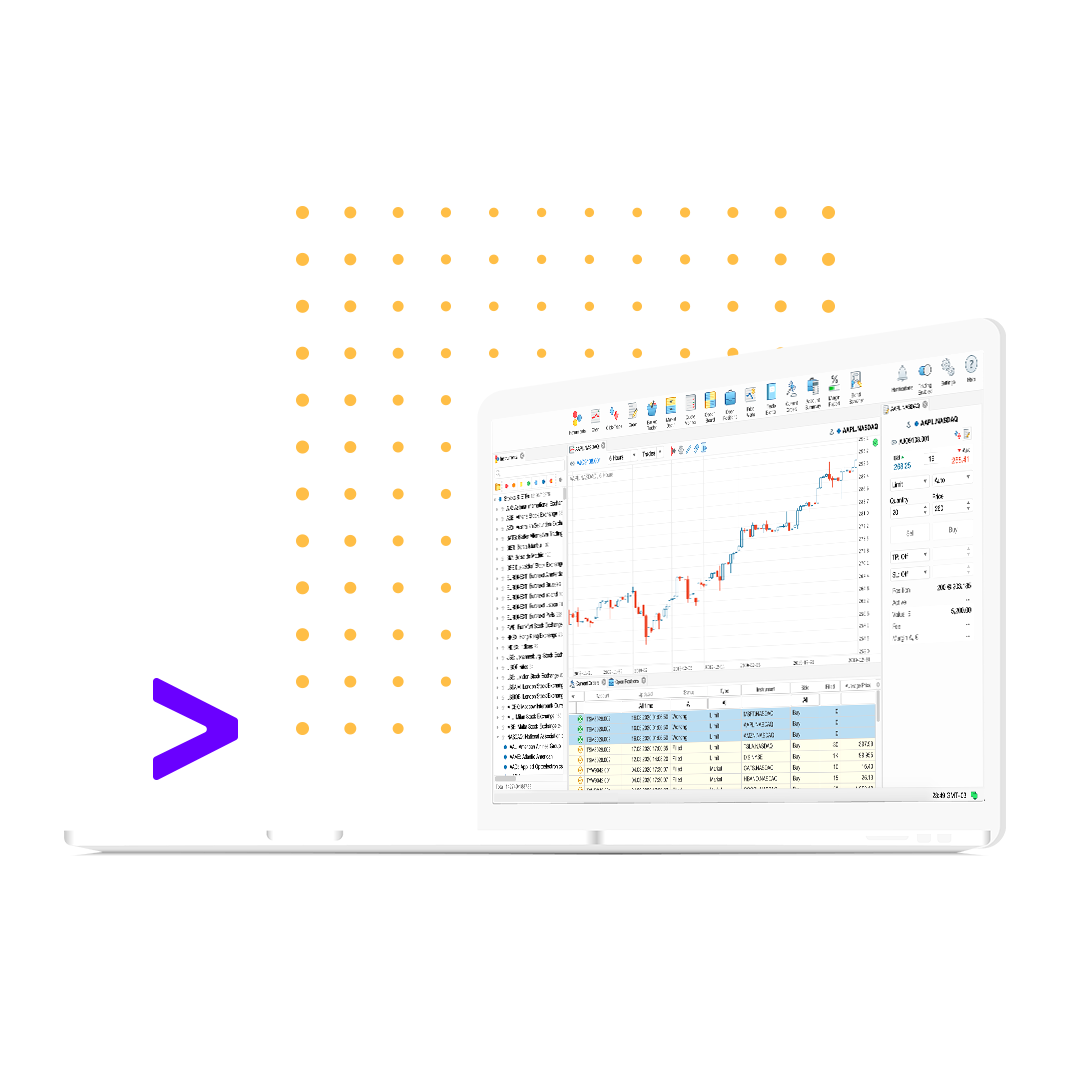

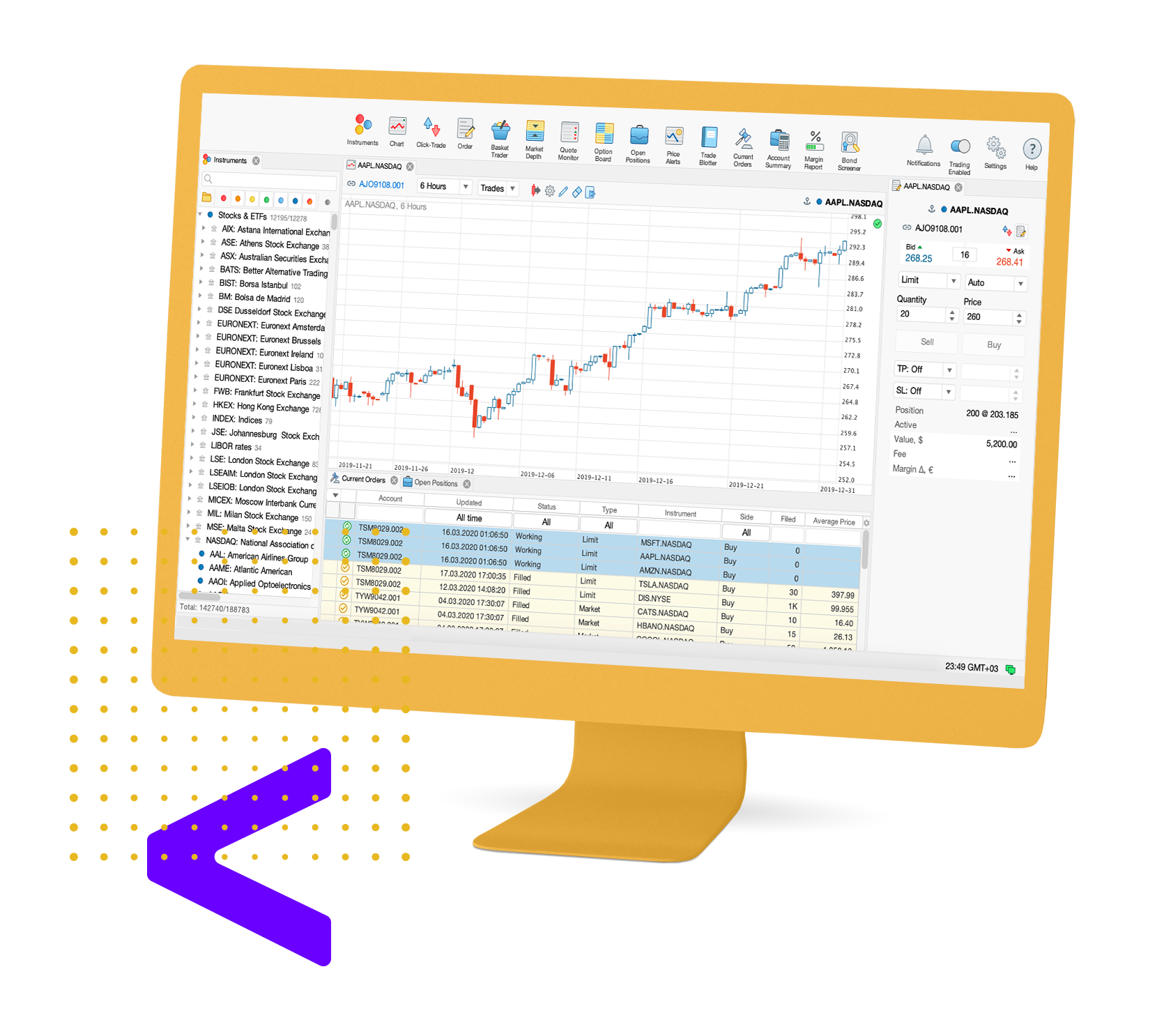

Desktop Platform

The powerful, yet easy-to-use trading tool for all major OS - Windows, macOS and Linux.

1

2

Web Platform

The web platform features a number of technical analysis and drawing tools and operates with minimum bandwidth requirements on any modern browser.

3

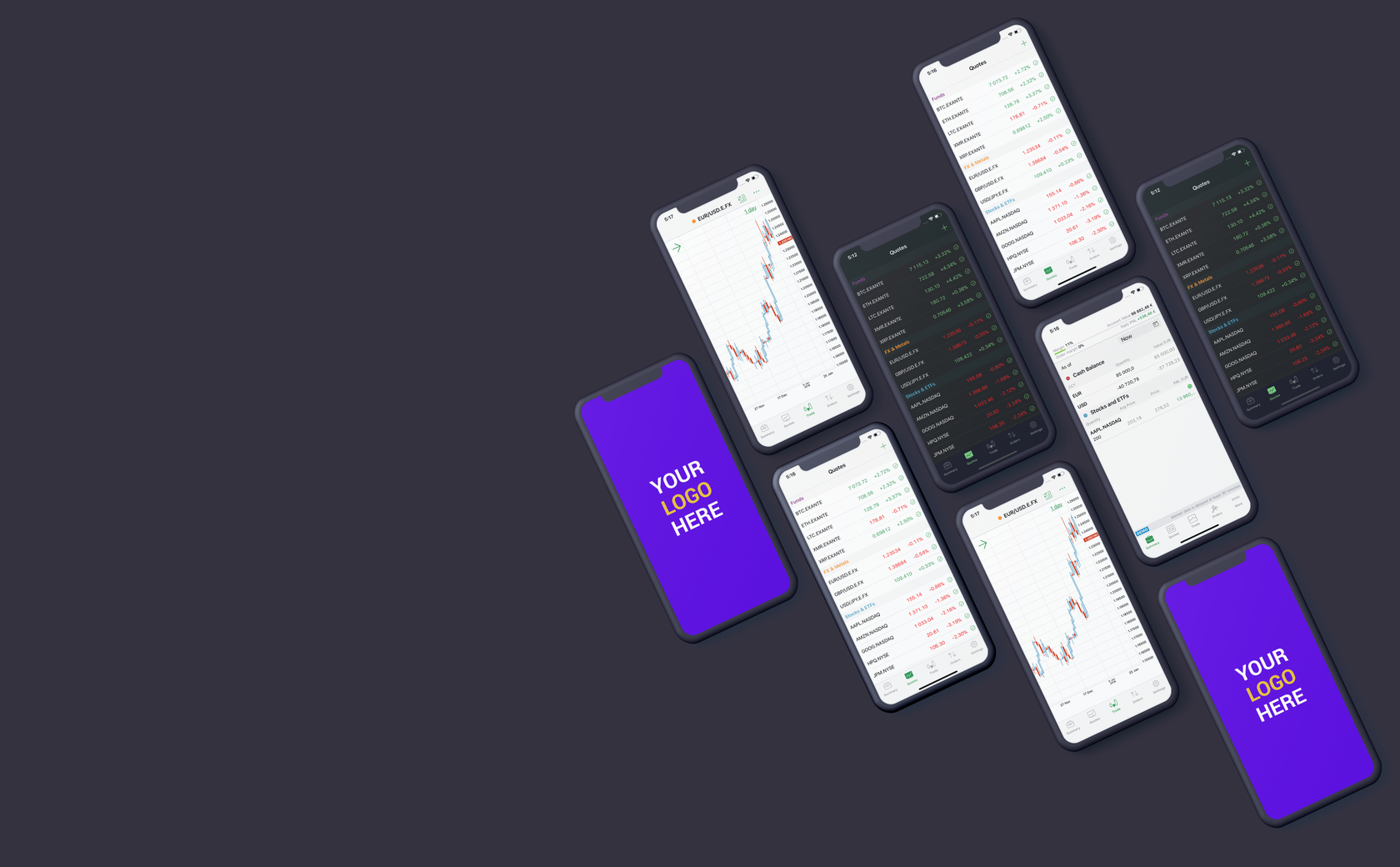

Mobile Platform (iOS or Android)

With our native apps, customers can track their orders on the go. The funds will always be at hand, just one click away, 24/7.

Opt for the mobile solution, and we'll publish the branded app with your logo and under your name in Google Play and AppStore.

Opt for the mobile solution, and we'll publish the branded app with your logo and under your name in Google Play and AppStore.

< The hands-on approach >

Hosted or standalone?

Run all onboarding and billing procedures on your own while we take care of the back end

We can either deploy the platform infrastructure on our servers or create a standalone environment on your side. Both options come with our maintenance services and 24/7 support.

Subaccounts are opened on an undisclosed basis

WLP is entirely responsible for acceptance and handling of individual accounts

Deposits and withdrawals to and from the main account as well as internal transfers between the main and subaccounts can only be performed by WLP

WLP is entirely responsible for acceptance and handling of individual accounts

Deposits and withdrawals to and from the main account as well as internal transfers between the main and subaccounts can only be performed by WLP

White Label Model

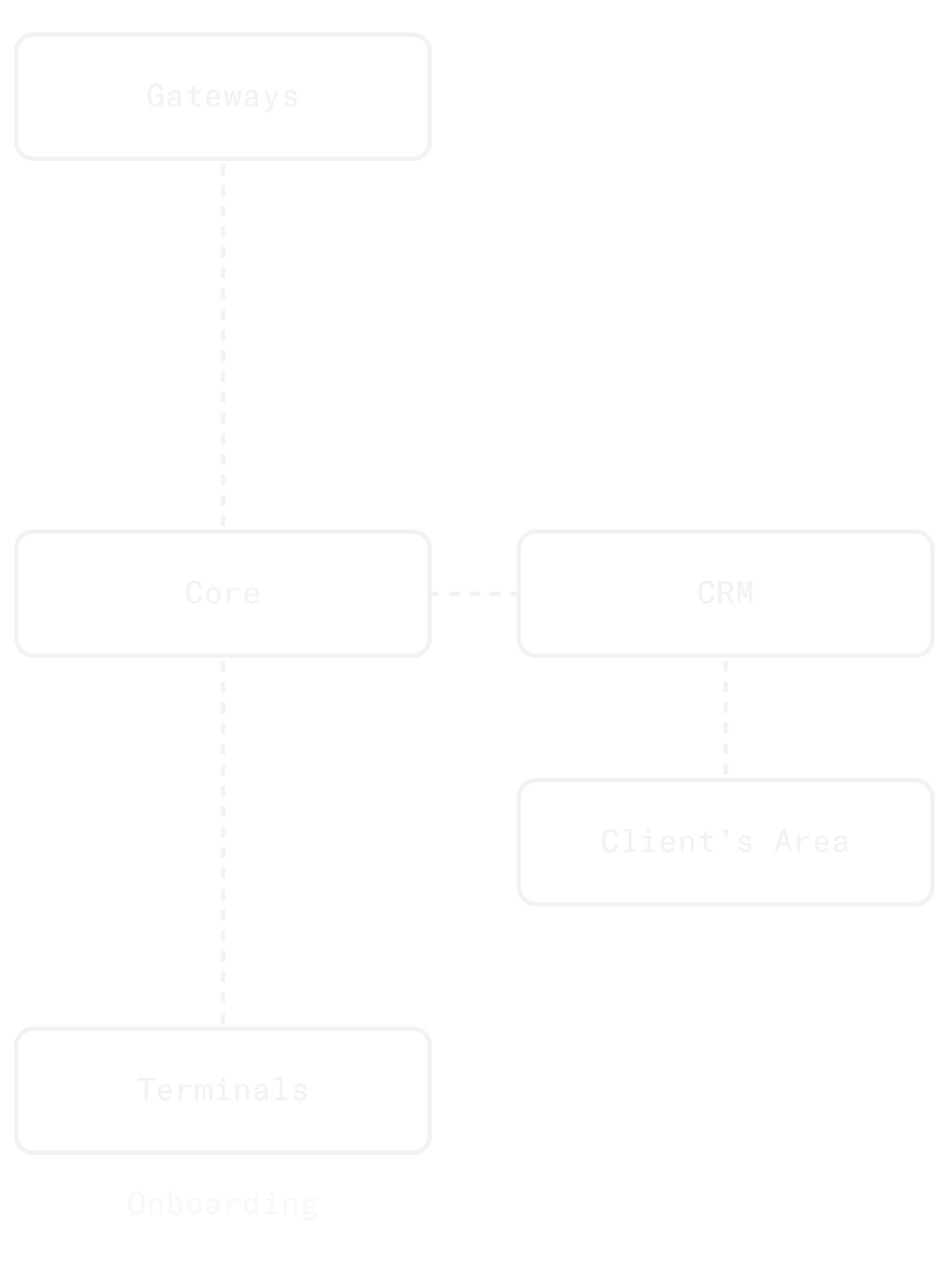

Core

The Core supports operations with all classes of instruments: stocks, ETFs, bonds, futures, options, metals and currencies. The Core facilitates everyday work of internal departments, including Finance, Trade Desk and Compliance. The Core module allows financial organisations to do accounting, access all order details and open positions and monitor risks.

- Accounts and user operations

- Authorisation and storage of permissions

- Trades processing

- Risk limit definition

- Storage of trade and financial transactions

- Storage of end-of-day (EOD) account statuses

- Processing fees and commissions

The Core caters to a wide range of operations:

CRM provides the tools to support the entire customer journey. You may choose specific client segments for massmails, notifications and other types of communication.

The CRM features include:

Customer Relationship Management (CRM)

- Roles and permissions

- Two factor authentication

- Funding: withdrawals and deposits

- Client requests

- Client notification

- Client activity logs

- Client categorisation

- Risk scoring

- API for internal communications

The platform includes Execution Gateways and Market Data Gateways, connecting to trading venues and data providers, respectively.

- Receive quotes

- Send orders

- Perform risk checks on order placement

- Update order statuses

Gateways

Gateways interact with a multitude of counterparties to:

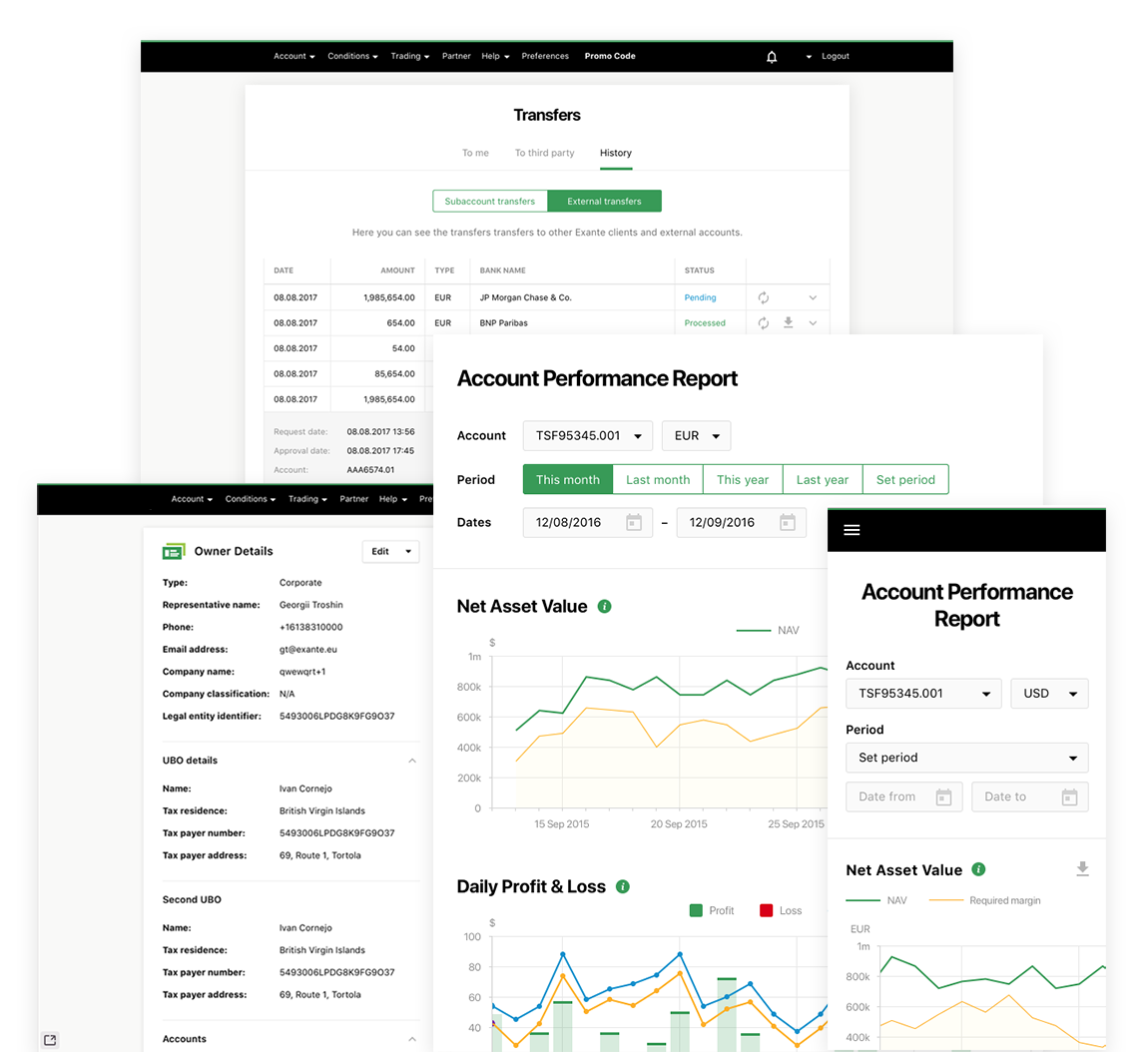

This module includes the end client's personal space and pulls data from Core and CRM. It features an onboarding wizard, account details, settings and downloads. The web edition also comes with the Client's Area.

Client's Area features:

- Transaction filtering

- Deposits and withdrawals

- Performance reports

- Net asset value, data loss

- Commissions

Client's Area

- Downloads

- Help and manuals

- Legal history

- Access rights

The Client's Area can be easily integrated with third party systems as a one stop login solution.

Trading Terminal Modules

The terminal offers direct order execution, advanced Trade Desk features, hedging and risk management.

< Highlights >

Asset managers will value the transparent Multi-Account Management, Option board, Basket Trader and the opportunities to rebalance portfolios.

MAM

(Multi-Account Management)

(Multi-Account Management)

MAM allows you to place orders for a chosen financial instrument on several accounts, thus saving time on account management.

Basket Trader

Drag instruments to Basket Trader, specify quantity and trade side, set a multiplier for the overall basket volume.

Option Board

The module features a list of call options to the left and put options to the right. In between, you will find the contract execution prices (option strikes).

Bond Screener

Bond searching tool - use multiple filters and criteria to find the most promising fixed assets on the markets.

All Modules

API integration

Seamless connectivity

We offer seamless connectivity with the partner's existing systems. Core and CRM API are available for third party integration. We also place orders and ensure trade execution for you.

We offer seamless connectivity with the partner's existing systems. Core and CRM API are available for third party integration. We also place orders and ensure trade execution for you.

FIX API

Full freedom of trading

Enjoy full freedom of trading on your end with FIX API, an electronic communication protocol for exchanging financial information. We support the full FIX Protocol ver. 4.4 — a de-facto industry standard for securities transactions and markets.

Whatever your hardware and computing resources, trade with ease right from your server. Implement a wealth of new trading strategies with your own software and equipment.

Enjoy full freedom of trading on your end with FIX API, an electronic communication protocol for exchanging financial information. We support the full FIX Protocol ver. 4.4 — a de-facto industry standard for securities transactions and markets.

Whatever your hardware and computing resources, trade with ease right from your server. Implement a wealth of new trading strategies with your own software and equipment.

HTTP API

Connectivity tools

Build your own financial apps

HTTP API enables you to design sleek, fast and data-rich financial applications - from smart messenger bots to wholesale trading solutions.

What can you do with HTTP API?

HTTP API enables you to design sleek, fast and data-rich financial applications - from smart messenger bots to wholesale trading solutions.

What can you do with HTTP API?

- Access any financial instrument available in the platform

- Get raw trade data or OHLC aggregated candles

- Place new orders or change the existing ones

- Track orders execution

- Integrate with your back office and trading systems.

We can customise the Client's Area to use the partner's branded imagery and even make code tweaks to make sure only the partner's name is featured.

Branding elements

Check out the full branding options!

We offer low entry barriers and flexible pricing models including one-off payment, fixed monthly fees, collateral funds and more. We are open to various forms of cooperation!

Fee structure

About Xntech

What we do

We develop feature-rich, fast and reliable software solutions for financial institutions.

Who we are

We are a team of fintech professionals who provide an individual approach to each client 24/7.

Our Mission

To enable fast time to market for enterprises and asset managers willing to empower their clients with state-of-the-art financial technology.

Facts and Figures

deliveries to leading financial clients

years

of consolidated experience

of consolidated experience

team members

10+

20+

20+

Headquarters in Switzerland, multiple development centres across the globe

Clients in Europe and Asia

Executive Director

Iurii Riabykin

Our team

Didzis Eglitis

Head of Marketing

David Sorokin

CTO

Team Lead Native Apps

Team Lead Android

Team Lead Frontend

Igor Efremov

Alexey Leshchuk

Alina Poluykova

Artyom Gildin

Team Lead Scala

Aleksei Cherepanov

Team Lead iOS

Our clients

| | Contact Us Fill the form and we will contact you in 24 hours for additional information. |